For stable asset management with crypto assets

Cryptocurrency is said to be a volatile yet promising investment method. On the other hand, the world of stable asset management using blockchain technology is equally important. xWIN.Finance aims to achieve this balance. Below are methods for stable asset management in the realm of cryptocurrency:

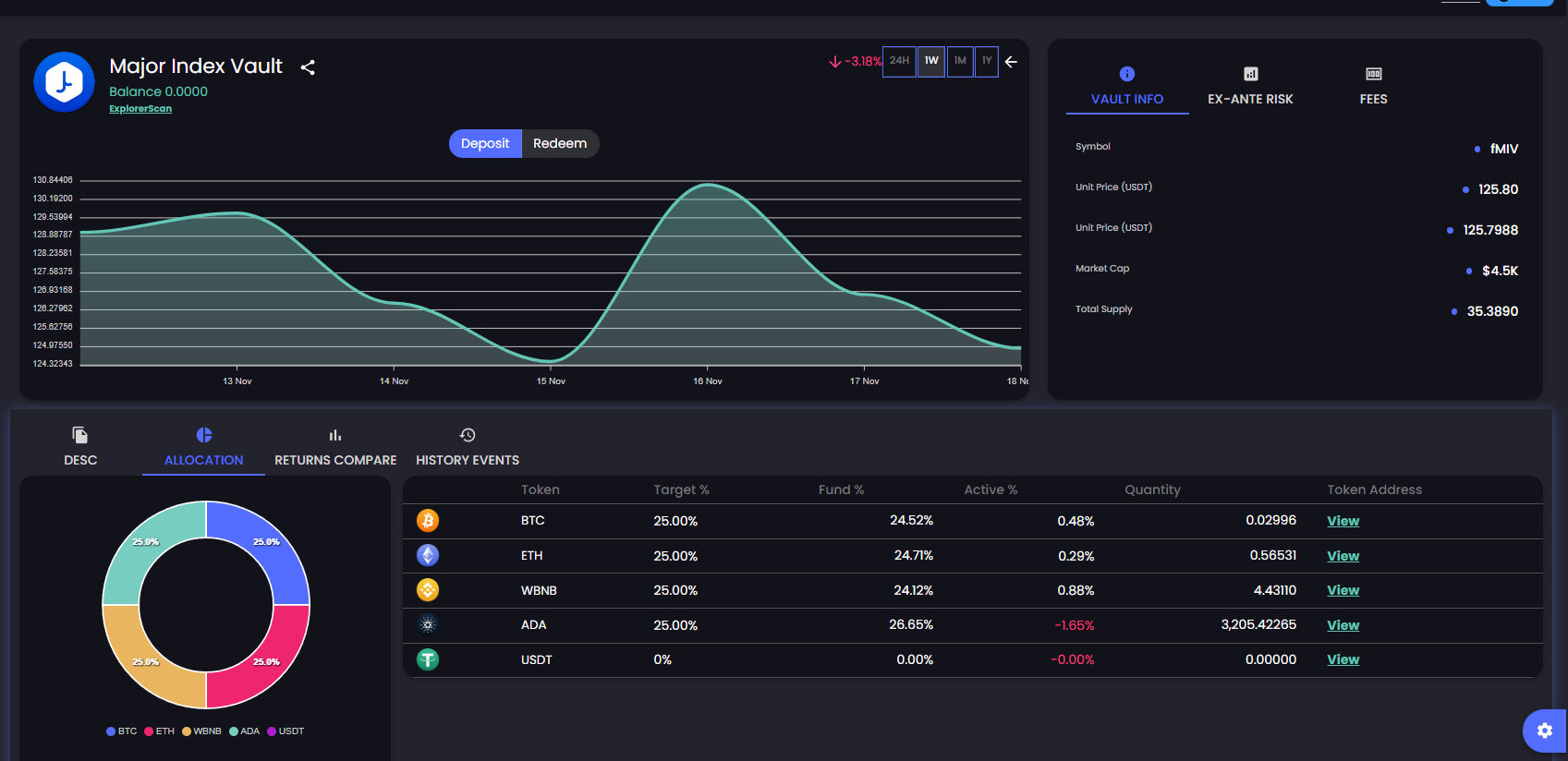

1. Diversified Investment:

Diversifying assets across multiple cryptocurrencies helps spread risk and enhance stability.

2. Regular Rebalancing:

Periodically reviewing and rebalancing the portfolio according to market conditions minimizes risk while optimizing returns.

3. Investment in Stable Coins:

Considering investments in certain stable coins provides protection against market fluctuations.

4. Expert Advice:

Seeking advice from experts or financial planners helps in establishing risk management and implementing appropriate strategies.

5. Tracking the Latest Information:

Constantly monitoring cryptocurrency market trends and staying updated with the latest information enables wise investment decisions.

To achieve the above five strategies, xWIN.Finance utilizes them daily. Please support us.